Prompt

We have been retained by a major cellphone manufacturer to investigate the impact of potential collusion between suppliers of cellphone batteries from 2019 to 2020. The manufacturer, TalkTek, alleges that the batteries it purchased for its phones were price fixed. That is, the suppliers of batteries colluded with one another to raise the price of batteries to downstream customers, such as TalkTek. This collusion constitutes price-fixing, which is illegal and can be prosecuted as a federal offense.

TalkTek is suing the phone battery manufacturers to recover damages for the harm caused by the alleged collusion. Damages are the difference between the actual price that TalkTek paid for batteries and the “but-for” price they would have paid but-for the alleged price-fixing.

Question #1:

What are some supply and demand factors that may affect the price of a cellphone?

Helpful hints

- Restate the question and clarify the key point before you begin

- Remember that we are analyzing a case from an economics perspective, rather than a business perspective

- Take time to gather your thoughts and plan your response, if you need it

- Use the language of the question to guide your response

- The question asks for “supply and demand factors,” so be sure to provide both to answer all parts of the question

Reveal answers to question #1

- Supply factors

- Cost of raw materials

- Cost of labor

- Other manufacturing costs

- Capacity of manufacturing facilities

- Demand factors

- Availability and price of substitutes

- Product quality

- Population characteristics and consumer trends

- Macro-economic factors

Need some help figuring out how we got these answers? Watch this video clip to learn more:

-

Example case question 1 play_circle_outline

Question #2:

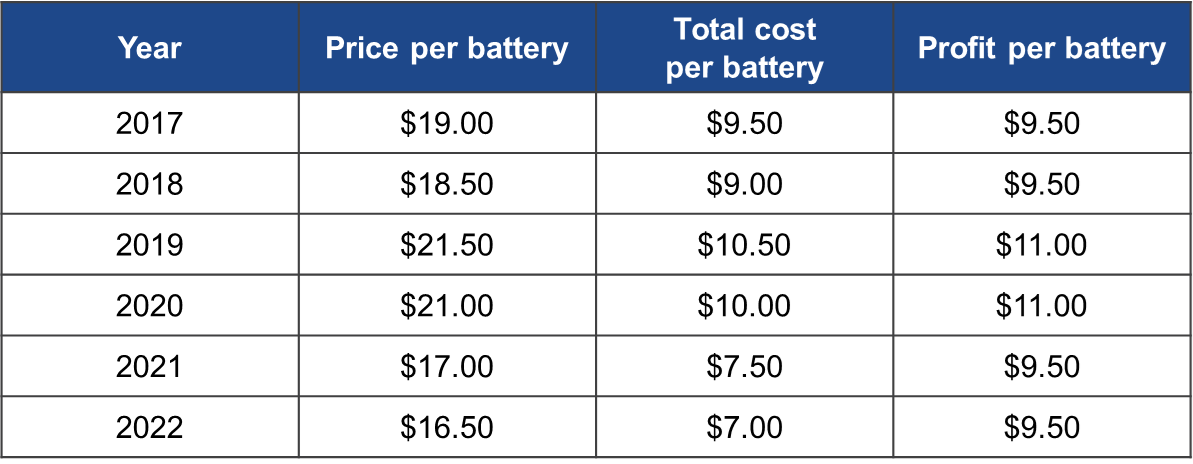

We have received data on prices of cellphone batteries. The table to the right provides the prices of cellphone batteries from 2017 to 2022. What trend(s) do you observe in the table? Based on the price trend, what should prices be in 2019 and 2020? How much did TalkTek potentially overpay for batteries in those years?

Helpful hints

- Don’t rush; take your time and look at all of the numbers provided to you before starting your answer

- Even if the math is easy, write out your calculations; correcting a wrong answer is easier when you can clearly identify where the calculations went wrong

Reveal answers to question #2

There is a general downward trend in prices, although prices are higher in 2019 and 2020. If you assume that, instead, prices should have continued decreasing at a rate of $0.50 a year, then TalkTek paid $3.50 more per battery than it otherwise would have in 2019 and 2020.

There is a general downward trend in prices, although prices are higher in 2019 and 2020. If you assume that, instead, prices should have continued decreasing at a rate of $0.50 a year, then TalkTek paid $3.50 more per battery than it otherwise would have in 2019 and 2020.

Need some help figuring out how we got these answers? Watch this video clip to learn more:

Question #3:

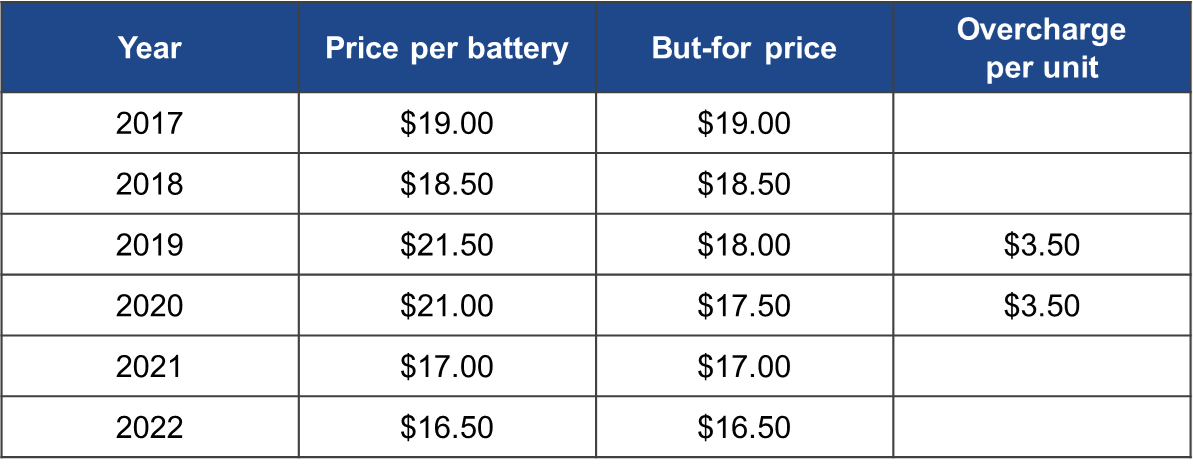

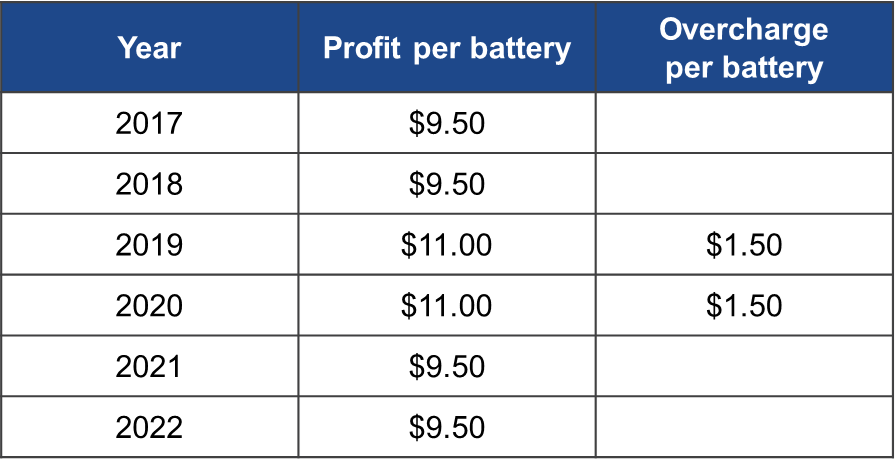

| The table to the right shows the total cost to manufacture a battery as well as the profit. Costs in 2019 and 2020 are higher due to a natural disaster. Assuming battery manufacturers priced their products to make a steady profit each year, what does this suggest about TalkTek overpayments in 2019 and 2020? Based on this assumption, what were per unit overcharges in 2019 and 2020? |

|

Reveal answers to question #3

Batteries still may have been price fixed in those years because profits were higher than in other years, but to a lesser extent than what we had previously calculated. Specifically, overpayment per unit was $1.50 instead of $3.50, since the actual price per battery of $3.50 above the but-for price is offset in part by the costs for 2019 and 2020 being $2.00 above the trend.

Batteries still may have been price fixed in those years because profits were higher than in other years, but to a lesser extent than what we had previously calculated. Specifically, overpayment per unit was $1.50 instead of $3.50, since the actual price per battery of $3.50 above the but-for price is offset in part by the costs for 2019 and 2020 being $2.00 above the trend.

Need some help figuring out how we got these answers? Watch this video clip to learn more:

Question #4:

How are customers ultimately impacted by the elevated price of TalkTek phone batteries?

Helpful hints

- Consider questions from a variety of different perspectives

- Be sure to qualify your answers as necessary; under what circumstances would you expect each outcome?

Reveal answers to question #4

- If consumer demand for TalkTek phones is unaffected by the price (i.e., demand is inelastic):

- Cellphone manufacturers may pass on higher battery prices to consumers

- Thus, consumers would be harmed by the price-fixing of TalkTek batteries

- If consumer demand for TalkTek phones is affected by the price (i.e., demand is elastic):

- Manufacturers may be unwilling to increase prices, so consumers may not be affected

- However, if the other smartphone batteries were also price fixed, all cellphones might be sold at a higher price, so consumers may still be harmed

Need some help figuring out how we got these answers? Watch this video clip to learn more: